College Students Balance Nutrition, Budgets

How students are budgeting in college

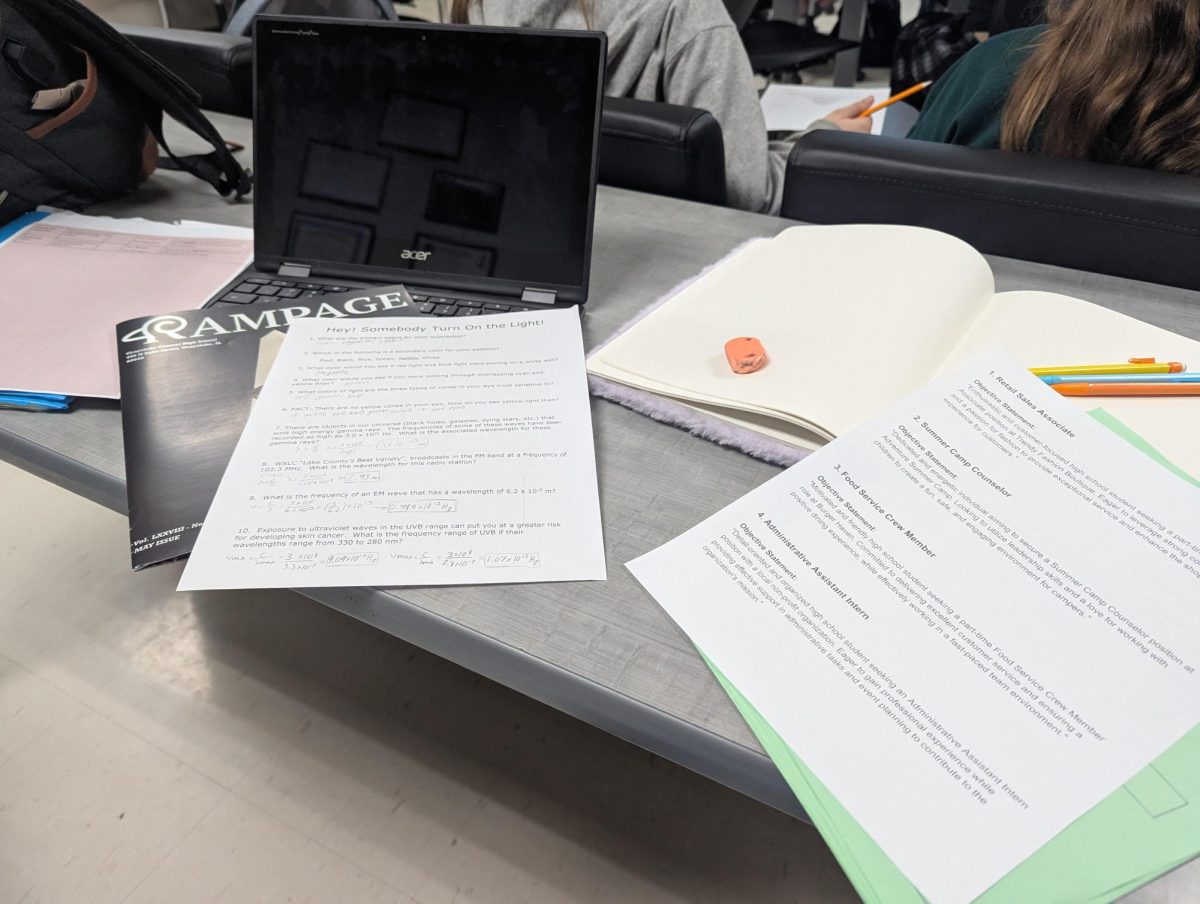

Lunch for a freshman at the University of Illinois Urbana Champaign

May 9, 2023

Many students put a lot of thought into the college they want to attend, and as a result, put a lot of effort into getting into that college. However, at the same time, many students fail to think about the money they will need after sending in that enrollment deposit. One solution is to live within a budget, and it’s never too early to start adapting to healthy financial habits.

College can be one of the most difficult transitions in one’s life, regardless of distance. Because of this, It’s hard to know what a person’s spending habits will be like in college. That being said, establishing a routine early on can positively affect your life as a college student. There are a number of ways to stay within a budget while living at a university. Your lifestyle and what you eat are one of the most important factors when it comes to how you spend money in college. As a result, meal plans are one of the most costly things at college, and can dent your spending money if you do not make the right choices. 2022 Rampage alumna Hayley Breines, now a student at DePaul University, is actively adjusting to spending money in college, and figuring out the options her campus has to offer. Breines explained some of the options at DePaul, explaining that, “I have a meal plan where I have flex dollars that I can spend at the university and different eating areas other than the dining hall.” Even though the college meal plan provides for Breines, she explained that, “For people that have more dietary restrictions than I do, it can be a little bit more tricky to find food on campus.” An example would be Breines’ friend, “who’s vegan and it’s hard for her to find a lot of good, extra protein-filled meals”. Another 2022 GCHS alumna, Aviva Blume, shares how she budgets her money as a freshman at the University of Illinois. Blume uses U of I’s campus dining halls every day, and believes they have a good variety of options that are easy for everyone to access. “I have a few favorite dining hall meals and really enjoy those, and I’m able to eat with my friends every night around my schedule which is pretty nice,” Blume shared. If you’re not eating at the dining halls and do not have a meal plan though, what options do you have? Even with a meal

plan, Breines still enjoys going out to eat, explaining that, “A lot of people go out to eat in college because it’s convenient, and it’s a lot more delicious than the food you’re getting on campus.” Going to restaurants around campus provides a fun college experience but, “It’s not cheap,” Breines said. Eating out consistently would not be sustainable for life, especially in college. Grocery shopping for meals can help save money with more food, and Breines says she grocery shops regularly at a nearby

Trader Joe’s, explaining that, “They have really good one-person meals that are quick and easy to microwave and make life easier.” Cooking meals from your dorm, while it may be hard, will end up saving you money in the long run.

It takes time to figure out what type of plan works best for you. “My plan for my paychecks that come…every two weeks is around 30% of it goes into my checking device savings. Then I try not to spend more than the amount that I put in my savings for… two weeks before I get my next paycheck,” Breines explained. Blume, however, believes the best way to budget your money is to stick to the dining hall as much as possible and to only eat out if you need to. Finding a routine that works for you, whether it’s saving up money from a job or using a school’s meal plans, is a necessary factor to plan for college. And, the best part may be that you will learn good habits that will be useful even after you graduate from college.