Investing creates new opportunities

Investing creates new opportunities for young generations

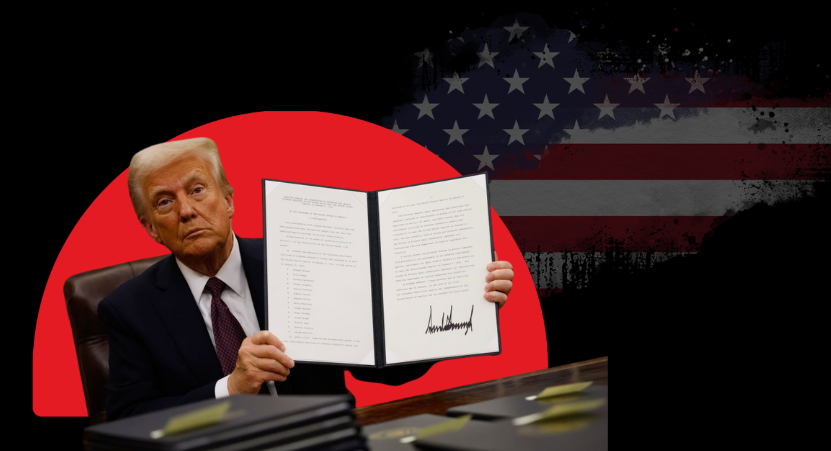

On Jan. 28, the Gamestop and AMC stock market boom creates new investors looking to get rich. The recent battle between individual investors and hedge funds has everyone looking for the next Gamestop.

March 3, 2021

As people grow older, they will begin to hear terms such as Roth IRA, 401k, compound interest, stock market, and more. For many young people, those terms tend to fly over their heads as they don’t think they are at the age where they are supposed to know what that stuff means. What if they did know what those things meant before they graduated from college or even high school? It could change their future.

There are two ways to save money. Either not spend it, or invest it and have it work for you to make you more money. By opening an investment account, you are creating yourself an opportunity to build compound interest.

“The concept of compound interest allows the money that you put in [an investment account] today to continue to grow and work for you… That money that you put in today, or this week or next month, will work for you until you retire and continue to grow and continue to multiply,” economics teacher Jason Janczak stated.

While there is a misconception that a lot of money is needed to begin investing, in reality, you can start with as little or as much money as you want.

“If you can start investing, like even a little bit, it will grow. . . if you can only buy ten shares of a stock or a little bit of a mutual fund, just do what you can, it will pay off in the long run,” said personal finance teacher Diane Keuth.

Roth IRAs, 401Ks, and mutual funds are just different types of ways to invest in the stock market safely for retirement. Unless you want to learn more about trading individual stocks or have the time in the day to watch the market fluctuate, these are your best options and safest options to grow your liquidity, but there is always a risk when money is involved.

“If you’re investing in retirement, understand that there’s going to be some downs. So don’t freak out in your retirement account and your Roth IRAs, when the market tanks, because it’ll come back,” Janczak said.

You can always minimize risk in the market. It depends where you put your money.

“Defensive stocks are ones that when the economy drops, people still continue to buy those things,” said Keuth.

Former GCHS student Keir Luczak has had some success in the stock market and provided some advice for those beginning their investing journey.

“Losing money is only one side of the market, and no one would do it if you only lost. Investing has a great deal of promise for the younger generation, and to expect the worst and receive the best is a feeling unmatched,” said Luczak.

Where there is a high reward, there is a high risk, and when trading in the market, managing risk your risk tolerance will determine the outcome of many trades. Risk tolerance is how long you can keep your money invested without becoming scared and removing it too soon.

A good example of this is the recent GameStop situation. On Jan. 28, 2021, Gamestop opened the market at $482.85 per share. Seven days before then, Gamestop was trading at around $42 per share.

“What happened was the billionaire hedge fund bought all these shares right for let’s say $10 a share. And people on Reddit caught wind of it. And what they did is to kind of stick it to the hedge fund. Let’s say I had a million shares I’ve borrowed at $10 from you, and I sold them, so I made 10 million. But now, 90 days is coming due… Instead of paying $3 a share, I’m paying $350 a share, to get those shares that I need to return to the broker,” explained Janczak.

Although the hedge funds lost money, many Reddit users did as well. Due to the high volatility produced by the Reddit users, many people bought the stock when it was too high or continued to hold their position thinking it was going to go higher. This is an example of risk tolerance. When risk was the highest that it could have possibly been, many chose to not sell. Those that did sell high made a lot of money. Those that continued to hold in hopes of the stock rising more lost possibly thousands.

While many people did make a lot of money from this situation, they won’t get 100% of their earnings back. That’s because just like every other job, you get taxed on your capital gains. Because these investors held the stock for less than a year, they will be taxed for short-term capital gains. Short-term capital gains tax can range from 10% to 37% of your earnings. Long-term capital gains range from 0% to 20%. To have long-term capital gains, you will need to hold a stock for more than a year. The rate you get taxed will be determined by how much money you made from the trade.

If you want to learn more on how to invest and find more information on long-term or short-term investing, Youtube is a great resource. It’s free and teaches you the basics of what you need to know about everything. If you want to start investing, you can use platforms such as TD Ameritrade, Etrade, Webull, and many more. You can start off with however much you feel comfortable with investing.